Crypto World News

- Bitcoin Price Plunges 40% From All-Time Highs to One-Year Lows

- VistaShares launches Treasury ETF with options-based Bitcoin exposure

- Bitcoin-Treasury The Smarter Web Company Listed on London Stock Exchange

- Bitcoin, crypto 'winter' soon over, says BitWise exec as gold retargets $5K

- Tether Launches Open-Source Bitcoin Mining Operating System

- ING Deutschland Opens Retail Access to Bitcoin Exchange-Traded Products

- Bitcoin borrowing shifts from short-term liquidity to long-term planning: Xapo

- Bitcoin ‘reflation’ bets diverge after US PMI breaks three-year resistance

- Bitcoin traders explain why BTC price could rebound toward $85K

- U.S. Government Takes Control of $400M in Bitcoin, Assets Tied to Helix Mixer

Crypto Market live

Crypto Updates Around The World

-

Bitcoin nears weekend low of $74,600 as stock selloff adds to crypto's woes

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 3 February 2026, 5:53 pm

Major declines in artificial-intelligence-linked stocks, software names and private equity are leading U.S. indices lower.Read More

-

VistaShares launches Treasury ETF with options-based Bitcoin exposure

Cointelegraph.com News - 3 February 2026, 5:32 pm

The NYSE-listed BTYB allocates most of its assets to US Treasurys while using options strategies to provide weekly income and Bitcoin-linked exposure.Read More

-

'You are not scaling Ethereum': Vitalik Buterin issues a blunt reality check to the biggest crypto networks

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 3 February 2026, 5:19 pm

The roadmap in place doesn’t make as much sense because progress among layer-2s toward later stages of decentralization has been slower and more difficult, and Ethereum itself is now scaling directly on layer-1.Read More

-

Bitcoin will 'massively' outperform gold over 10 years, says Pantera's Dan Morehead

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 3 February 2026, 4:57 pm

“I think crypto starts to become invisibly more part of everyone’s lives,” said Tom Lee — the two appeared on a panel together Tuesday morning at the Ondo Summit in New York.Read More

-

Spain to follow UK with proposal to ban social media for children under 16

Cointelegraph.com News - 3 February 2026, 4:48 pm

Pedro Sánchez announced that Spain would implement several changes to laws impacting social media platforms starting next week, with potential criminal liability for executives.Read More

-

Bitcoin, crypto 'winter' soon over, says BitWise exec as gold retargets $5K

Cointelegraph.com News - 3 February 2026, 4:36 pm

Bitcoin failed to attack $80,000 resistance as gold sought a $5,000 reclaim, while analysis argued that “crypto winter” began in January 2025.Read More

-

World Liberty launches $3.4B stablecoin: How it fits into onchain credit systems

Cointelegraph.com News - 3 February 2026, 4:01 pm

World Liberty launches a $3.4-billion stablecoin and lending platform, positioning it within onchain credit, collateralized loans and DeFi markets.Read More

-

Solana to reach $2,000 by 2030 despite recent plunge to $100, says Standard Chartered

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 3 February 2026, 3:59 pm

Analyst Kendrick Geoffrey trimmed his 2026 SOL forecast to $250 from $310, but says stablecoin micropayments could drive a longer-term surge as Solana moves beyond memecoins.Read More

-

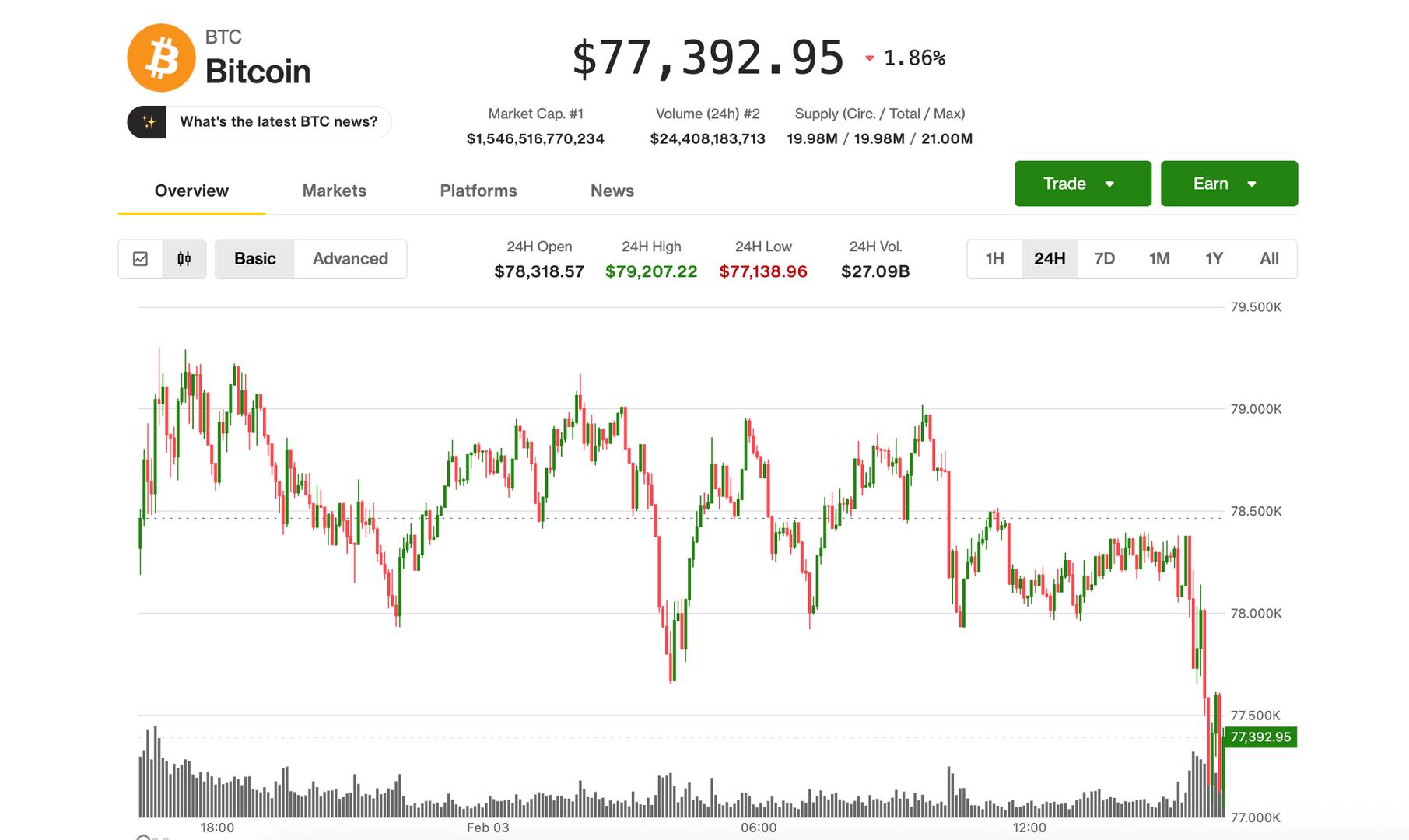

Bitcoin bounce fails, with price falling back to $77,000 while precious metals renew surge

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data - 3 February 2026, 3:34 pm

Silver is higher by nearly 15% on Tuesday, while gold is nearing $5,000 per ounce after a 6.5% gain.Read More

-

Did Solana bottom at $100? SOL price charts hint at a 150% rally

Cointelegraph.com News - 3 February 2026, 3:18 pm

Solana price technicals suggest that the recent correction to $100 was a buy-the-dip opportunity as traders look for a recovery path toward $260.Read More